Regulating Pharmacy Benefits Is a Prescription for Higher Health Costs

North Carolinians pay some of the highest health insurance premiums in the country, and they’re worried about prescription drug costs, too. Costs are likely to increase on both fronts if state lawmakers pass HB 246, a bill creating new regulations for pharmacy benefits.

Among other things, HB 246 sets a minimum price level for drug reimbursements to pharmacies, mandates a new dispensing fee, and “restricts the use of preferred pharmacy networks.” The bill passed the North Carolina House unanimously last year, and it’s expected to resurface again during this year’s legislative short session.

That’s unfortunate. HB 246 is bad policy, with a big price tag.

Here’s why: HB 246 introduces new costs and constrains pharmacy benefit managers, or PBMs, who serve as intermediaries between health plans, pharmacies, and drug companies. PBMs negotiate drug prices, form pharmacy networks, offer mail-order pharmacy services, and more. They’re part of a complicated health care delivery system, to be sure, but in simple terms, they work within networks to “combine and reduce prescription drug costs for plan participants,” notes ERIC, a national advocacy group. HB 246 would hinder their capacity to do that.

Bill sponsors, who want to protect smaller, independent pharmacies, believe the legislation “evens the playing field” in drug distribution and health care, according to news reports. Yet a large swath of data confirms PBMs create cost efficiencies, ultimately saving money for businesses and consumers. Some notable data points:

PBMs drive cost savings of 40-50% on prescription drug and related health costs for payers and patients, research shows.

Per person cost savings from PBMs average $962 annually, according to an earlier study—or as much as $1,040, according to other data.

PBMs provide $145 billion in annual value, according to a 2022 study from the University of Chicago.

Another relevant reality: Prescription drug costs are already a pain point for consumers in North Carolina, so there’s no margin for policies that exacerbate that problem. According to a 2023 survey from Altarum Healthcare Value Hub, 58% of North Carolinians say they’re worried about prescription drug affordability.

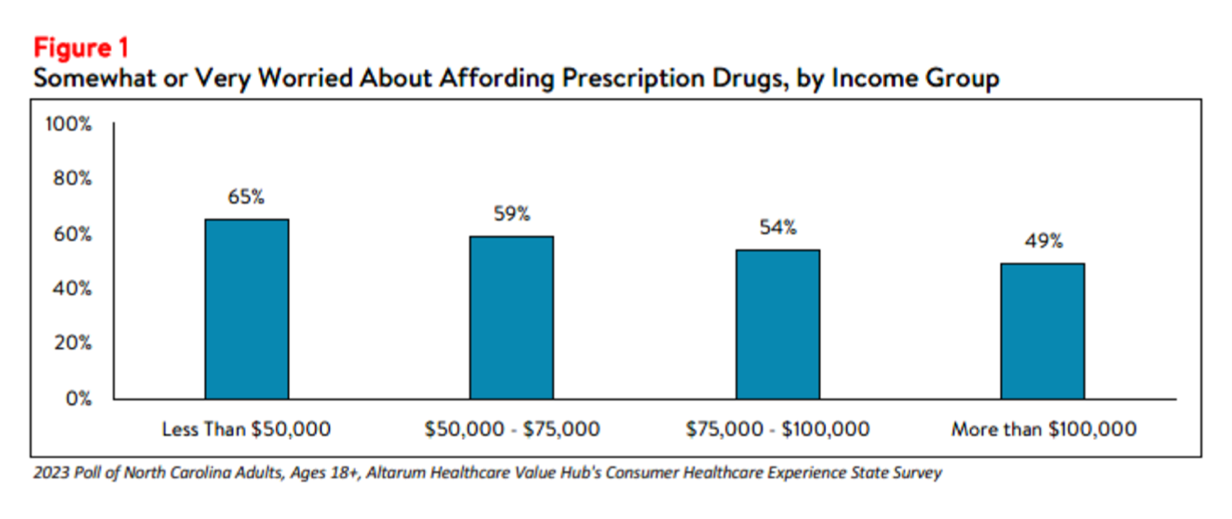

Concern is especially acute for low-income North Carolinians—but also substantial for those with incomes over $100,000. Here’s the breakdown by income level:

Source: Altarum Healthcare Value Hub, 2023 Consumer Healthcare Experience State Survey.

In addition, HB 246 would harm and constrain businesses, argues Les Merritt, a former state auditor. “HB 246 would increase costs for health plan sponsors, like employers, by limiting their ability to use lower-cost pharmacy options in the coverage plans they provide. It would also add a new $10.24 fee for most prescriptions filled in North Carolina and take choices away from patients by preventing employers from covering certain pharmacies, like those that offer home delivery.”

Opposition to HB 246 last year was substantial and included the NC Chamber, which dubbed it an “anti-business” bill. Lawmakers in the Senate wisely declined to pass it.

They understand this: More mandates worsen the health care cost problem. What’s the remedy? Here’s a high-level answer from Christina Smith of Citizens Against Government Waste, writing about regulating PBMs: “Free market competition, not government interference, is the best solution to drive down prices in health care and other industries.”

We agree.