Personal Income Taxes.

CPR believes personal income tax rates should be no higher than is necessary for government to meet its basic obligations.

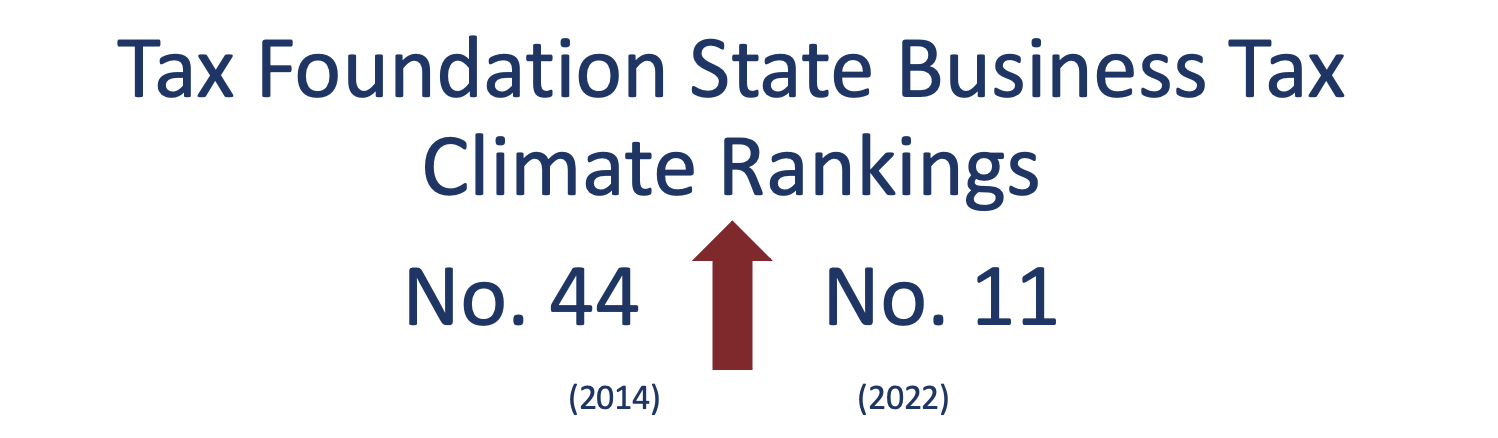

North Carolina has become a national leader in efforts to simplify, reform, and modernize outdated and onerous tax codes. Since 2011, the Reform Majority has undertaken major tax reforms that helped usher in a boom decade for North Carolina.

The first step was eliminating over $1 billion annually in “temporary” sales taxes and income taxes that former Gov. Bev Perdue and legislative liberals levied on working families at the peak of the Great Recession. They were forced to levy these devastating tax increases during a historic recession because they didn’t sock away money in the Rainy Day Fund during the boom years.

The Reform Majority initiated a plan that dramatically reduced personal income tax rates:

Lowered the personal income tax rate from a high of 7.98% (including a surtax that upped the statutory rate) in 2010 to a flat 4.99% in 2022.

Set in law a schedule to reduce the personal income tax rate each year until it reaches 3.99% in 2027.

Increased the amount of tax-free income North Carolinians can claim as the standard deduction to $12,750 for single or $25,500 for married filing jointly.

Add it all up, and 99% of N.C. taxpayers pay less or no state income taxes at all thanks to the Reform Majority.

Over the past five years, North Carolina’s median household income has increased by 14.8% – the highest growth in the southeast (Source: St. Louis Fed).

Corporate Income Taxes.

CPR believes that taxes are already paid on corporate profits by the employees and shareholders who earn them.

When the Reform Majority took charge in 2011, North Carolina had the highest corporate income tax rate in the southeast. Today, North Carolina has the lowest corporate income tax rate in the country (excluding states that have no corporate income tax).

The corporate income tax rate is scheduled for elimination in 2030.

In recent years, major corporations have expanded or headquartered in North Carolina, including Toyota, Pratt Whitney, Wolfspeed, Thermo Fisher, Google, VinFast, and the world’s largest company, Apple.